Between mutually exclusive projects having similar return, the decision should be to invest in the project having the shortest payback period. Management uses the payback period calculation to decide what investments or projects to pursue. In essence, the payback period is used very similarly to a Breakeven Analysis, but instead of the number of units to cover fixed costs, it considers the amount of time required to return an investment. The decision rule using the payback period is to minimize the time taken for the return on investment.

Lifespan of an Asset

By investing in bonds, the investor aims to preserve capital while earning interest, balancing their portfolio to mitigate volatility. The equation does not calculate cash flows in the years past the point where the machine is expected to be paid off. It’s possible those cash flows will be higher than the previous years. The payback period method is particularly helpful to a company that is small and doesn’t have a large amount of investments in play.

Comprehensive Guide to Inventory Accounting

- Financial analysts will perform financial modeling and IRR analysis to compare the attractiveness of different projects.

- For instance, let’s say you own a retail company and are considering a proposed growth strategy that involves opening up new store locations in the hopes of benefiting from the expanded geographic reach.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- In addition, the potential returns and estimated payback time of alternative projects the company could pursue instead can also be an influential determinant in the decision (i.e. opportunity costs).

This investment decision requires evaluating factors such as diversification, management fees, and the investor’s own expertise in selecting stocks. If the individual prefers a hands-off approach and diversification, they may choose a mutual fund, while a more experienced investor seeking higher potential returns may opt for direct stock investments. The cost of capital helps companies evaluate potential projects and investments by providing a minimum acceptable return threshold. Due to its ease of use, payback period is a common method used to express return on investments, though it is important to note it does not account for the time value of money. As a result, payback period is best used in conjunction with other metrics.

Use of Payback Period Formula

Machine X would cost $25,000 and would have a useful life of 10 years with zero salvage value. Let’s say Jimmy does buy the machine for $720,000 with net cash flow expected at $120,000 per year. The payback period calculation tells us it will take him 6 years to get his money back. When he does, the $720,000 he receives will not be equal to the original $720,000 he invested. This is because inflation over those 6 years will have decreased the value of the dollar.

Payback Period Vs Return On Investment(ROI)

The cost of capital is the rate of return that an organization must earn on its investments to satisfy investors and lenders. It serves as a benchmark for evaluating new projects and investments, guiding financial decisions to ensure that returns meet or exceed investor expectations. Understanding the role of cost of capital is critical for making informed strategic and financial decisions. An investor chooses to buy shares of a technology company after analyzing its financial health, growth potential, and industry trends. This decision involves researching the company’s earnings reports, market position, and competitive advantages. The investor also considers their risk tolerance and investment horizon, deciding whether to invest for short-term gains or long-term growth, thus reflecting a strategy based on personal financial goals.

FAQs About Discounted Payback Period

One of the most important capital budgeting techniques businesses can practice is known as the payback period method or payback analysis. That’s why business owners and managers need to use capital budgeting techniques to determine which projects will deliver the best returns, and yield the most profitable outcome. This still has the limitation of not considering cash flows after the discounted payback period.

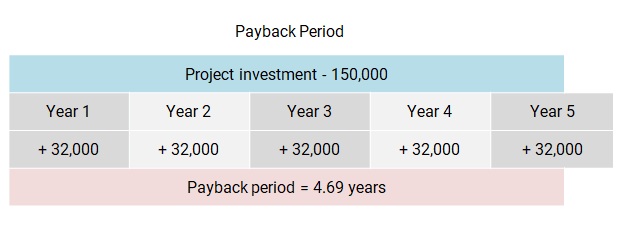

The second project will take less time to pay back, and the company’s earnings potential is greater. Based solely on the payback period method, the second project is a better investment if the company wants to prioritize recapturing its capital investment as quickly as possible. The payback period disregards the time value of money and is determined by counting the number of years it takes to recover the funds invested. For example, if it takes five years to recover the cost of an investment, the payback period is five years.

As the equation above shows, the payback period calculation is a simple one. It does not account for the time value of money, the effects of inflation, or the complexity of investments that may have unequal cash flow over time. The Payback Period Calculator can calculate payback periods, discounted payback periods, average returns, and schedules of investments. Payback period refers to the number of years it will take to pay back the initial investment. Discounted payback period refers to the number of years it takes for the present value of cash inflows to equal the initial investment. The payback period value is a popular metric because it’s easy to calculate and understand.

According to payback method, the project that promises a quick recovery of initial investment is considered desirable. If the payback period of a project is shorter than or equal to the management’s maximum desired payback free estimate templates for word and excel period, the project is accepted, otherwise rejected. For example, if a company wants to recoup the cost of a machine within 5 years of purchase, the maximum desired payback period of the company would be 5 years.

In reality, projects are unlikely to have constant annual projected returns. In this case, setting up a table in Excel will help evaluate and estimate the payback period. A higher payback period means it will take longer for a company to cover its initial investment. All else being equal, it’s usually better for a company to have a lower payback period as this typically represents a less risky investment. The quicker a company can recoup its initial investment, the less exposure the company has to a potential loss on the endeavor. The answer is found by dividing $200,000 by $100,000, which is two years.