When it comes to restaurant accounting, the chart of accounts categorizes the money you spend and receive. The chart of accounts records high-level transactions like revenue, expenses, assets, liabilities, cost of goods sold, and equity. Each of these buckets is further categorized into smaller ones, such as meat costs, alcohol costs, staff wages, marketing, utilities, laundry, etc. And proper inventory management ensures optimal financial health and better profit margins. What’s more, accurate inventory management leads to fewer accounting errors. It is therefore imperative to your success that you strive for precise inventory counts at all times.

Restaurant accounting methods

- Awareness and strategic actions can keep your financial ship smoothly sailing.

- Although it may not be as exciting as other parts of the restaurant biz, without doing it, you wouldn’t be able to have a restaurant in the first place.

- The restaurant accounting year is another option that can be useful for those restaurants that only need financial information once per year (such as for tax purposes).

- At any given moment, you peek at your sales-to-labor ratio or determine if sales are meeting historical averages.

- The first topic is an introduction to the top budgeting mistakes you can make, followed by a brief look into accounting periods, general restaurant accounting methods, etc.

- At Bookkeeping Chef, our experienced team of restaurant consultants offers a complete menu of services that will help your independent restaurant to minimize tax liabilities and maximize cash flow.

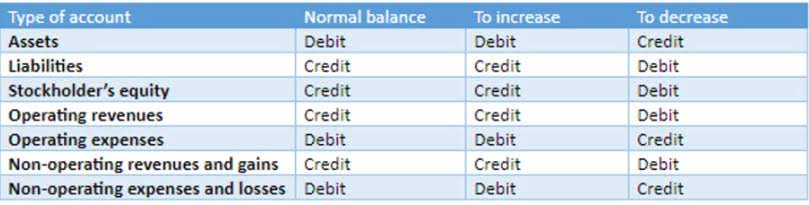

For reference, many industry sources share that an average restaurant has a profit margin of about 7% but recognize yours can fall anywhere between 0-12%. Because of its importance in every area of your business, you must get the right information out of your accounting systems. This will help to improve food and beverage sales and profitability while also keeping track of financial obligations like restaurant payroll taxes or other state regulations. A good POS system though will allow you to track labor costs, inventory counts and different methods of payment as well as generating sales reports. Choosing the right POS system forms a link between the front of house and the back of house accounting system, making your daily invoicing much more facilitated. The chart of accounts is often used as the source of truth for a restaurant’s finances and helps to inform other financial documents, such as balance sheets, profit and loss statements, and cash flow statements.

Restaurant bookkeeping vs restaurant accounting

It can be a huge advantage for you to hire someone who has this knowledge since it may save them time when completing certain tasks or projects. It is important to understand how much money you need, what drives profitability, and all of the factors which influence restaurant success. Once you have gained a better understanding of each one, you will be able to see how they can all work together for your restaurant to run more effectively. If you are unsure how much to charge for certain items during these events, then you may want to use the cost-plus pricing method. This means that you will take your product’s total costs and add a certain percentage on top of it in order to determine what price you should sell it for. After you have reviewed the records, you should be able to get a fairly accurate prediction of how much money your restaurant will make in the future.

Chart of Accounts (COA)

By examining these costs, you can help to ensure that the business has a chance of being profitable after all expenses have been taken into consideration. Data has shown that the restaurant business is growing, with an average sales increase of 8%. Occupancy expenses include things like rent or lease payments as well as utilities and other bills related to running your restaurant. The main benefit of using the accrual accounting system is it allows restaurant owners to more accurately reflect expenses and revenue in their financials. This refers to the type of accounting method that includes expenses and revenues together in one financial statement balance sheet at the end of an accounting period. Essentially, it is based on estimates rather than actual figures for expenses and sales revenue.

For DIY bookkeepers, this means careful record-keeping and keeping a close eye on your tax obligations. That’s why we want to take you through some of the common terms, reports and processes for understanding bookkeeping and accounting for restaurants. Whether you’re curious about how to do bookkeeping, or working with a bookkeeper and accountant, this guide is here to help. Accrual accounting provides more precision but requires more bookkeeping. Instead of recognizing revenue and expenses when cash changes hands, accrual accounting matches revenue and expenses when they’re incurred. Unless your business has a dine-and-dash problem, you shouldn’t have to worry about accounts receivable, or the balance customers owe for already-rendered goods and services.

The most common accounting method of restaurants is cash accounting or cash basis. This method allows businesses to record their generated income when cash is received from services rendered or paid for expenses and costs. Since restaurants and bars deal with a lot of cash daily, this method is the preferred method. Many restaurant business owners are not aware of the basic accounting concepts that can make them more profitable and help with recording financial transactions. This blog post will cover some of the basics, including what they all mean and how to use them to improve restaurant income and operating expenses. The first topic is an introduction to the top budgeting mistakes you can make, followed by a brief look into accounting periods, general restaurant accounting methods, etc.

- Some of the most commonly used accounting ratios include working capital ratio, turnover ratio, asset utilization and liquidity ratios.

- Restaurant bookkeepers generally are responsible for recording and coding transactions, managing accounts payable and receivable, handling payroll, reconciling bank statements, and keeping track of inventories.

- That’s why we want to take you through some of the common terms, reports and processes for understanding bookkeeping and accounting for restaurants.

- A restaurant’s inventory is food and beverages, both of which have expiration dates.

- WISK makes spreadsheets a thing of the past and lets you manage invoices, ordering, costs, inventory, recipes and more in one single app.

- Owners and employees in management roles may not retain any tips intended for employees.

How Do Financial Statements Help Manage Costs?

- In addition to providing outsourced bookkeeping and payroll services, we also have a full a service tax, accounting division to help you keep more money in your pocket and less in Uncle Sam’s.

- You can choose between cash basis accounting and accrual accounting depending on your profit amounts.

- They are related because bookkeeping lays the groundwork for accounting, but these processes serve different functions.

- The keyword here is decision-making because having good information about how much money you are making (or losing) and where that money comes from (and goes to) is critical to making good business decisions.

- This practice is integral to managing the total cost of running your restaurant.

- Here is a list of the reports you’ll need for your restaurant accounting – and what they ultimately show you.

Depending on your circumstances, the prime cost of a menu item may be simply calculated by taking an average of what you paid for that food or drink. Alternatively, it can also be determined by looking at the exact prices which were charged to specific invoices from suppliers you have received and labor needed to keep your restaurant in production. A chart of accounts includes all the various types of revenue, costs, assets, and liabilities related to your restaurant over time. In most cases, these costs will be deducted from a restaurant’s revenue. However, if you are charging your customers for some of the things that labor cost covers then you might want to consider adding it as an expense in your financial reports. Gross profit margin is a ratio that tells you how much of every dollar earned has been kept by the restaurant after all expenses have been paid.

But a well-run restaurant can’t settle for a general accountant or accounting firm. POS systems connect every point of your business – from inventory to sales – and integrate with various other systems, such as accounting platforms and employee management software. This means it’s easy to collate all your financial data on your COGS, sales, stock on hand, accounts payable, labor costs etc., to help manage your accounting. Perform regular inventory counts and adjust your records to reflect current stock levels. This accuracy is significant for calculating actual food cost and managing your inventory effectively. Accurate inventory management helps restaurant owners maintain control over their operating expenses.

So, when you are selecting a restaurant CPA firm, it is recommended that you look for a firm that has hospitality expertise alongside an intricate understanding of restaurant-specific accounting nuances. At Bookkeeping Chef, our experienced team of restaurant consultants offers a complete menu of how to do bookkeeping for a restaurant services that will help your independent restaurant to minimize tax liabilities and maximize cash flow. In addition to providing outsourced bookkeeping and payroll services, we also have a full a service tax, accounting division to help you keep more money in your pocket and less in Uncle Sam’s.